If you’re just starting out in crypto or stock trading, you may have come across two common terms: Market Order and Limit Order. These are the most basic types of orders you’ll use to buy or sell assets like Bitcoin or stocks on an exchange.

In this article, we’ll explain what these two order types mean, how they work, and when to use each one. No complicated jargon — just simple, clear information.

Contents

What Is a Market Order?

A market order is the fastest way to buy or sell an asset.

When you place a market order, you are saying, “I want to buy or sell right now at the best available price.”

Here’s how it works:

-

You enter the amount you want to buy or sell.

-

The system finds someone willing to trade with you.

-

The trade happens instantly.

Example:

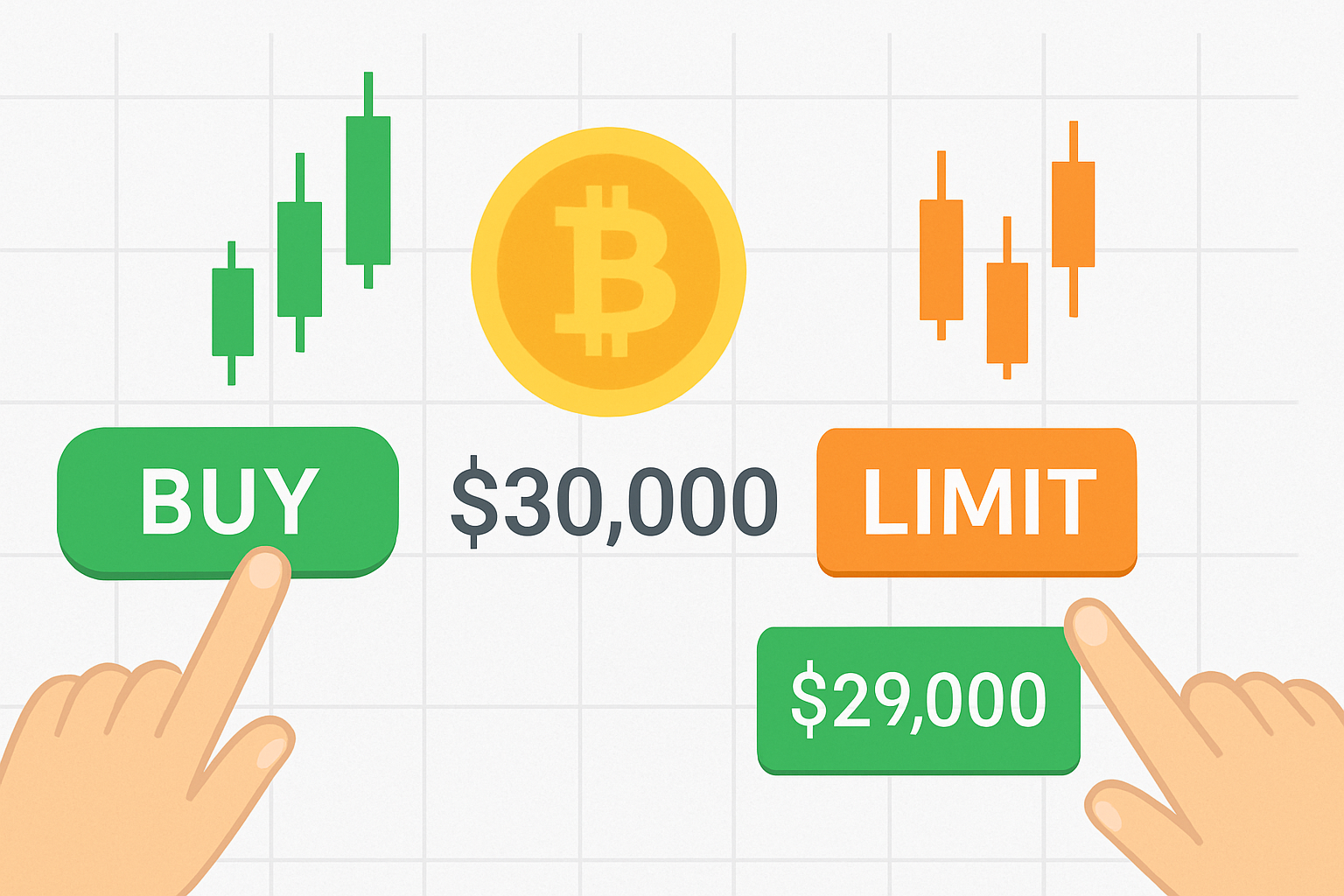

Let’s say you want to buy Bitcoin (BTC), and the current price is $30,000.

If you place a market order for 0.1 BTC:

-

The system finds the lowest price someone is selling it for.

-

You instantly get 0.1 BTC.

-

You might pay slightly more or less than $3,000 depending on how fast the price is changing.

Market orders are all about speed, but you don’t control the exact price.

What Is a Limit Order?

A limit order lets you set the price at which you want to buy or sell.

When you place a limit order, you are saying, “I want to buy or sell, but only at this specific price or better.”

Your order won’t be filled right away unless the market hits your price.

Example:

Let’s say BTC is $30,000, but you want to buy only if the price drops to $29,000.

You place a limit buy order at $29,000 for 0.1 BTC.

-

The order stays open on the exchange.

-

If the price drops to $29,000 or lower, your order gets filled.

-

If the price never drops, your order remains unfilled.

Limit orders give you price control, but they are slower and may not happen at all.

Market Order vs Limit Order: Key Differences

| Feature | Market Order | Limit Order |

|---|---|---|

| Speed | Very fast | Slower, depends on market conditions |

| Price Control | No — you accept the market price | Yes — you choose your price |

| Execution Guarantee | Yes | No |

| Good For | Quick trades | Strategic buying/selling |

When to Use a Market Order

Use a market order when:

-

You want to buy or sell quickly

-

You are OK with the current market price

-

You are trading high-volume assets (like BTC, ETH, AAPL)

Tip: Be careful using market orders in low-volume markets — prices can jump quickly, and you may pay more than expected.

When to Use a Limit Order

Use a limit order when:

-

You want a better price

-

You’re not in a hurry

-

You’re placing a trade during high volatility

Tip: Limit orders are useful when you expect the price to move but want to avoid overpaying or underselling.

Pros and Cons

Market Order

Pros:

-

Instant execution

-

Easy for beginners

-

Useful during fast-moving markets

Cons:

-

No control over price

-

Can cost more during big price swings

Limit Order

Pros:

-

Set your own price

-

Can get better value

-

Good for long-term planning

Cons:

-

No guarantee your trade will happen

-

Takes more time and planning

Final Thoughts

Understanding the difference between market orders and limit orders is a big step toward becoming a smart trader.

-

Use market orders when speed is more important than price.

-

Use limit orders when price is more important than speed.

As a beginner, start with small amounts and try both order types to see how they work. Many exchanges like Binance, Coinbase, or Kraken make it easy to choose between market and limit orders with just one click.

Learning how and when to use these tools will help you trade more confidently and protect your money.